175

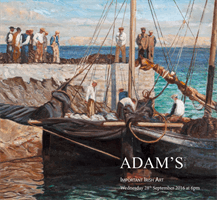

www.adams.ieImportant Irish Art | 28th September 2016

Reserves

24. Subject to the Auctioneer’s discretion, the seller shall be entitled prior to the auction to place a

reserve on any Lot. All reserves must be agreed in advance by the Auctioneer and entered on the Sale

Order Form or subsequently be confirmed in writing to the Auctioneer prior to auction. This also applies

to changes in reserves. A reserve may not be placed upon any Lots under IR£100 in value. The reserve

shall be the minimum Hammer Price at which the Lot may be sold by the Auctioneer. A reserve once

in place may only be changed with the consent of the Auctioneer. A commission shall be charged on

the ‘knock-down’ bid for Lots which fail to reach the reserve price. Such commission shall be 5% of the

‘knock-down’ bid. This commission and any VAT payable thereon must be paid before removal of the Lot

after the auction. The minimum commission hereunder shall be IR £25. The Auctioneer may in its sole

discretion sell a Lot at a Hammer Price below the reserve therefore but in such case the Proceeds of Sale

to which the seller shall be entitled shall be the same as they would have been had the sale been at the

reverse.

Unless a reserve has been placed on a Lot in accordance with the provisions set out above such Lot shall

be put up for sale without reserve.

In the event that any reserve price is not reached at auction then for so long as the Lot remains with the

Auctioneer and to the extent that the Lot has not been re-entered in another auction pursuant to condi-

tion 31 the seller authorises the Auctioneer to sell the Lot by private treaty at not less than the reserve

price. The Auctioneer shall ensure that in such a case those conditions herein which concern mainly the

buyer shall, with any necessary modification, apply to such sale.

Commission

25. The seller shall pay the Auctioneer commission at the rate of 10% on the Hammer Price of all Lots

sold on behalf of the seller at Irish Art Sales and 17.5% on the Hammer Price of all Lots sold on behalf

of the seller at Fine Art, Wine and Militaria Sales together with V.A.T. thereon at the applicable rate. The

seller authorises the Auctioneer to deduct from the Hammer Price paid by the buyer the Auctioneer’s

Commission under this condition; VAT payable at the applicable rates and any other amounts due by the

seller to the Auctioneer in whatever capacity howsoever arising. The seller agrees that the Auctioneer

may also receive commission from the buyer pursuant to condition 13.

Insurance

26. Unless otherwise instructed by the seller, all Lots (with the exception of motor vehicles) deposited

with the Auctioneer or put under its control for sale shall automatically be insured by the Auctioneer

under the Auctioneer’s own fine arts policy for such sum as the Auctioneer shall from time to time in its

absolute discretion determine. The seller shall pay the Auctioneer a contribution towards such insurance

at the rate of 1% of the Hammer Price plus VAT. If the seller instructs the Auctioneer not to insure a Lot

then the Lot shall at all times remain at the risk of the seller who undertakes to indemnify the Auctioneer

and hold the Auctioneer harmless against any and all claims made or proceedings brought against the

Auctioneer of whatever nature and howsoever and wheresoever occurring for loss or damage to the Lot.

The sum for which a Lot is covered for insurance under this condition shall not constitute and shall not

be relied upon by the seller as a representation, warranty or guarantee as to the value of the Lot or that

the Lot will, if sold by the Auctioneer, be sold for such amount. Such insurance shall subsist until such

time as the Lot is paid for and collected by the buyer or, in the case of Lots sold which are not paid for or

collected by the buyer by the due date hereunder for payment or collection such due date or, in the case

of Lots which are not sold, on the expiry of seven (7) days from the date on which the Auctioneer has

notified the seller to collect the Lots.

Recision of Sale

27. If before the Auctioneer has paid the Proceeds of Sale to the seller the buyer proves to the satisfac-

tion of the Auctioneer that the Lot sold is a Forgery and the requirements of condition 20 are satisfied

the Auctioneer shall rescind the sale and refund to the buyer any amount paid to the Auctioneer by the

buyer in respect of the Lot.

Payment of Proceeds of Sale

28. The Auctioneer shall remit the Proceeds of Sale to the seller not later than thirty (30) days after the

date of the auction, provided however that, if by that date, the Auctioneer has not received the Total

Amount Due from the buyer then the Auctioneer shall remit the Proceeds of Sale within seven (7) work-

ing days after the date on which the Total Amount Due is received from the buyer. If credit terms have

been agreed between the Auctioneer and the buyer the Auctioneer shall remit to the seller the Proceeds

of Sale not later than thirty (30) days after the date of the auction unless otherwise agreed by the seller.

If before the Total Amount Due is paid by the buyer the Auctioneer pays the seller an amount equal to

the Proceeds of Sale then title to the Lot shall pass to the Auctioneer.

If the buyer fails to pay the Auctioneer the Total Amount Due within fourteen (14) days after the date

of the auction, the Auctioneer shall endeavour to notify the seller and take the seller’s instructions on

the course of action to be taken and, to the extent that it is in the sole opinion of the Auctioneer feasi-

ble, shall endeavour to assist the seller to recover the Total Amount Due from the buyer provided that

nothing herein shall oblige the Auctioneer to issue proceedings against the buyer in the Auctioneer’s

own name. If circumstances do not permit the Auctioneer to take instructions from the seller or, if after

notifying the seller, it does not receive instructions within seven (7) days, the Auctioneer reserves the

right, and is hereby authorised by the seller at the seller’s expense, to agree special terms for payments

of the Total Amount Due, to remove, store and insure the Lot sold, to settle claims made by or against

the buyer on such terms as the Auctioneer shall in its absolute discretion think fit, to take such steps as

are necessary to collect monies due by the buyer to the seller and, if necessary, to rescind the sale and

refund money to the buyer.

Payment of Proceeds to Overseas Sellers

29. If the seller resides outside Ireland the Proceeds of Sale shall be paid to such seller in Irish Punts unless it was

agreed with the seller prior to the auction that the Proceeds of Sale would be paid in a currency (other than Irish

Punts) specified by the seller in which case the Proceeds of Sale shall be paid by the Auctioneer to the seller in

such specified currency (provided that that currency is legally available to the Auctioneer in the amount required)

calculated at the rate of exchange quoted to the Auctioneer by its bankers on the date of payment.

Charges for Withdrawn Lots

30. Once catalogued, Lots withdrawn from sale before proofing/publication of Catalogue will be subject to com-

mission of 5% of the Auctioneer’s latest estimate of the auction price of the Lot withdrawn together with VAT

thereon and any expenses incurred by the Auctioneer in relation to the Lot. If Lots are withdrawn after proofing

or publication of Catalogue they will be subject to a commission of 10% of the Auctioneer’s latest estimate of the

auction price of the Lot withdrawn together with VAT thereon and any expenses incurred by the Auctioneer in

relation to the Lot. All commission hereunder must be paid for before Lots withdrawn may be removed.

Unsold Lots

31. Where any Lot fails to sell at auction the Auctioneer shall notify the seller accordingly and (in the absence of

agreement between the seller and the Auctioneer to the contrary) such Lot may, in the absolute discretion of the

Auctioneer, be re-entered in the next suitable auction unless instructions are received from the seller to the con-

trary, otherwise such Lots must be collected at the seller’s expense within the period of thirty (30) days of such

notification from the Auctioneer.

Upon the expiry of such period the Auctioneer shall have the right to sell such Lots by public auction or private

sale and on such terms as the Auctioneer in its sole discretion may think fit. The Auctioneer shall be entitled to

deduct from the price received for such Lots any sums owing to the Auctioneer in respect of such Lots including

without limitation removal, storage and insurance expenses, any commission and expenses due in respect of the

prior auction and commission and expenses in respect of the subsequent auction together with all reasonable

expenses before remitting the balance to the seller. If the seller cannot be traced the balance shall be placed in

a bank account in the name of the Auctioneer for the seller. Any deficit arising shall be due from the seller to the

Auctioneer. Any Lots returned at the seller’s request shall be returned at the seller’s risk and expense and will not

be insured in transit unless the Auctioneer is so instructed by the seller.

Auctioneer’s Right to Photographs and Illustrations

32. The seller authorises the Auctioneer to photograph and illustrate any Lot placed with if for sale and further

authorises the Auctioneer to use such photographs and illustrations and any photographs and illustrations pro-

vided by the seller at any time in its absolute discretion (whether or not in connection with the auction).

Catalogue illustrations are included at the discretion of the Auctioneer. Illustration charges will be calculated on

the particular category of sale. These charges are subject to change. Irish Art Sale Illustrations: €150.00 full page,

€100.00 half page, €50.00 other sizes. Fine Art Illustrations: Scaled fee: €100.00 for lots sold for €3,000.00 and

over, hammer price, €50.00 for lots sold under €3,000.00 hammer price. All other sales: €25.00 per illustration. All

lots illustrated and not sold are charged €25.00 per illustration.

VAT

34. It is presumed, unless stated to the contrary, that the items listed herein are auction scheme goods as

defined in the Finance Act 1995.

35. Artist’s Resale Rights (Droit de Suite)

Government Regulations (S.1. 312/2006)

Under this legislation a royalty (droit de suite) is payable to artists or the artist’s heirs (if deceased in the last 70

years) of E.U. nationality on all works resold for €3,000 or more, other than those sold by the artist or the artist’s

agent.

The resale royalty payable is calculated as follows:

__________________________________________

From €3,000 to €50,000 4%

From €50,000.01 to €200,000 3%

From €200,000.01 to €350,000 1%

From €350,000.01 to €500,000 0.5%

Exceeding €500,000 0.25%

The total amount of royalty payable on any individual sale shall not exceed €12,500 The seller is liable for pay-

ment (paragraph 7.1 of Government Regulations (S.1. 312/2006) of this royalty on completion of the sale. The

artist may request from the Auctioneer any information necessary to secure payment.

The Auctioneer will automatically deduct the amount due from the proceeds of sale and will hold in trust for the

artist, their heirs or their representative for a period of 3 years from the date of sale. A vendor may choose to

check the ARR Waiver on the Sale Receipt Contract indicating that they accept sole responsibility for the payment

and authorises the Auctioneers to disclose their contact details to the artist, their heirs or their representative.